Medicaid Asset Protection

Our firm is committed to helping our clients protect their assets – whether you are 35 or 75, if you have something to lose, it’s never too early to protect it for yourself and your family.

While no one likes to think about growing older, the fact is, if you’re over 65, there’s a strong likelihood that you’ll need long-term care at some point in the future. Unfortunately, neither standard health insurance nor Medicare will pay for those services. Without proper planning, exorbitant long-term care costs could quickly deplete your savings and consume any assets you intended to leave to your loved ones.

But it doesn’t have to be that way.

By taking the time to establish a Medicaid Asset Protection Trust today, while you’re still independent and healthy, you can ensure you’ll be able to access the long-term care services you might need without spending yourself into impoverishment.

At Smith Legacy Law, we believe it’s essential to plan for the possibility of long-term care well before it’s needed. If you’re interested in exploring a Medicaid Asset Protection Trust, we’re ready to help you develop a plan for preserving and protecting your family’s future.

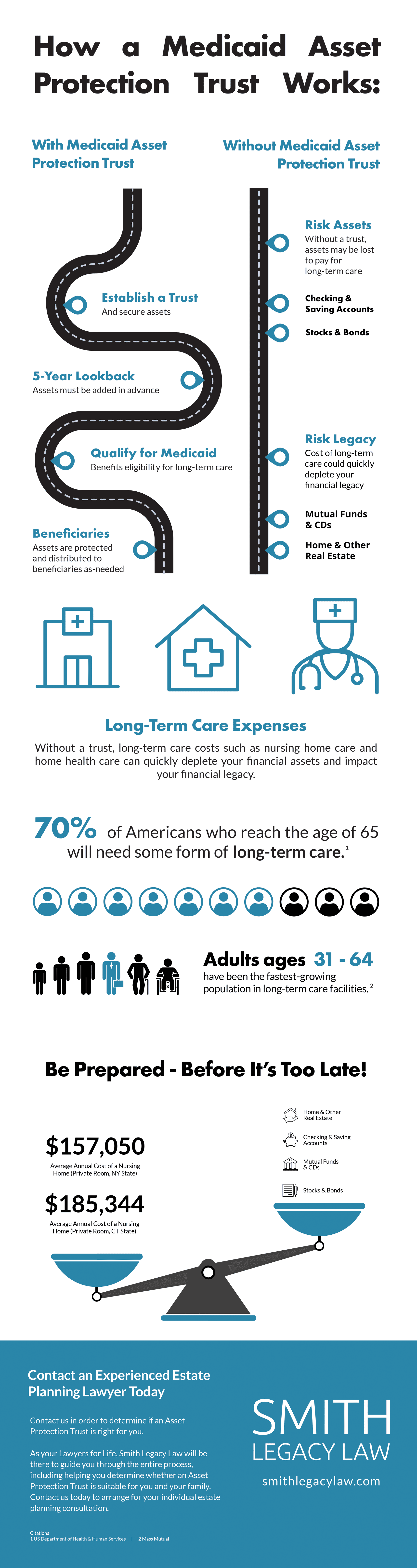

Long-Term Care Costs Won’t Stop Rising Anytime Soon

The cost of long-term care can vary significantly from one geographic region to another. But regardless of locale, quality care never comes cheap, and costs keep on growing.

Annual increases in long-term care costs have historically hovered between 2% and 6% per year. However, one recent survey found those costs jumped significantly in 2021, mainly due to the disruption brought on by the COVID-19 pandemic, as well as a widening gap between the demand for such services and the supply of professionals able to deliver them:

- Assisted Living Facility: Rates increased by 4.65% to an annual national median cost of $54,000 per year. Connecticut average nursing home cost is $182,000, and New York is $147,000.

- In-Home Services: Cost of a home health aide for personal care assistance increased by 12.5% to an annual median of $61,776, while rates for homemaker services spiked by 10.64% to an annual median cost of $59,488.

- Skilled Nursing Facility: The national annual median cost of a semi-private room rose to $94,900, an increase of 1.96%, while the cost of a private room increased 2.41% to $108,405.

Although Medicare and private health insurance won’t cover long-term care costs, Medicaid will. But because it’s considered a safety net of last resort, you must meet the program’s eligibility rules, including strict financial requirements. Without proper planning, Medicaid won’t kick in until your financial assets are depleted, and you’re officially considered “impoverished.”

How Does a Medicaid Asset Protection Trust Work?

Medicaid is a federal and state insurance program that helps cover healthcare costs for those with limited incomes. To qualify for Medicaid, household assets must fall below a certain level. Those rules are stringent, and there’s currently a five-year look-back period to ensure an individual is eligible for benefits.

A Medicaid Asset Protection Trust allows a person to qualify for long-term care benefits from Medicaid while protecting assets from depletion. As long as the trust was created and assets transferred five years before the donor applied for Medicaid long-term care benefits, there will be no penalty for transferring assets and the trust’s existence will not impact Medicaid eligibility.

Assets that may be placed in a Medicaid Asset Protection Trust include:

- Home and other real estate

- Checking and saving accounts

- Stocks and bonds

- Mutual funds and CDs

Contact an Experienced Medicaid Lawyer Today

The rules governing a Medicaid Asset Protection Trust are complex and vary from state to state. You’ll also need a long-term plan for the assets and their eventual transfer to other family members.

As Your Lawyers for Life, Smith Legacy Law can help determine whether a Medicaid Asset Protection Trust is suitable for you and your family.